What Are You Looking For?

Become A Member

We believe in the credit union tradition of people helping people, and we do everything we can to help our members.

Become a member to become a part-owner—that’s right, we work for you and deliver the personal attention and financial services you deserve. Benefit from awesome membership perks, including opportunities to help you develop and get on track to fulfill your life plans and get a loan. Plus receive competitive rates, lower service fees, higher returns on savings, and truly personal service.

Membership at Extra Credit Union is open to all who reside, work, worship, or attend schools within the state of Michigan. View account opening disclosures.

Ready To Join?

- Complete a membership application online or in person at any Extra Credit Union location.

- When you join, we will need:

- A one-time, $5 deposit required to purchase a share of membership in the credit union that must be retained in the Primary Savings account at all times;

- A valid driver’s license or equivalent picture ID for you and all joint owners;

- Verification of Social Security number for you and for all joint owners.

- Transferring from another banking or credit union? Switching is easy with our Quick Switch Kit.

Checking Accounts

- Account numbers don't change

- Nationwide ATMs

- eBanking

- Autopay

- No transaction fees

- FREE box of checks

- Identity theft protection

- Buyer's protection

- Cell Phone Protection

- Health discount savings

- Shopping rewards

- Travel and leisure discounts

Protect Your Checking Account

Isn’t it embarrassing to get stuck without enough cash at the register? (Awkward!) At Extra Credit Union, you have three different ways to protect your checking account to avoid overdraft fees, and hassles:

Mastercard® Secure Code

MasterCard Secure Code provides advanced security for online shopping when using your Extra Credit Union debit card.

flexLINE of Credit

This revolving line of credit transfers funds to your checking account to cover a purchase when there are non-sufficient funds (NSF). Repayments are made from the member’s account in which they designate. Apply for flexLINE of Credit to get started.

Overdraft Transfer

If your checking account is overdrawn, funds from another Extra Credit Union account can be automatically transferred to cover the cost (for a fee of $3 per transfer). Call or visit Extra Credit Union to set up this service from the account of your choosing today.

Courtesy Pay*

This overdraft program covers you for overdrafts up to $500 when making purchases, which helps members with checking accounts in good standing to avoid a non-sufficient funds fee, bounced check or late fees. Courtesy pay is automatically added to your account after 90 days, with no application necessary. The program does not automatically apply to ATM withdrawals or purchases at retailers. For Point-of-Sale Pay {allows Courtesy Pay to kick in when making purchases with an ATM or debit card}, you must opt in. If you’re already enrolled in this service and wish to discontinue, you must opt out. The quickest way to enroll or discontinue this service is by logging in to eBanking. Next, select the opt in/opt out Point-of-Sale Pay option under the “services” tab. Or, feel free to call us at (586) 276-3000 for assistance.

* The courtesy pay program is just that, a courtesy, and is not an extension of credit. It does not constitute a written agreement of obligation or a pre-arranged agreement for Extra Credit Union to pay a member’s overdrafts, and we may withdraw the service at any time. Point-of-Sale Pay is not automatically available for ATM withdrawals or PIN-generated debit transactions; you must opt in. Please review the courtesy pay policy or call Extra Credit Union at (586) 276-3000 for complete details.

FUTURITY

Bonus Checking

We created FUTURITY checking and savings accounts for 16-24 year olds to introduce you to checking, savings, and building your credit safely and gradually. We bundled together a variety of services to get you established and to help you learn how to use financial tools safely.

FUTURITY checking and savings accounts enable you to:

- Access your account 24/7 from anywhere

- Save your money for your college tuition

- Build your credit for future purchases of a new car or a home

- Reduce and even reimburse certain service fees

- The student has a cumulative GPA of 3.0 or higher

- Student completes the LearningLab+ program at ExtraCreditUnion.org

- Student sets up direct deposit

Savings Accounts

Extra Credit Union offers four flexible savings accounts to help you save for your goals. We can guide you in selecting the one that is best for you. Plus, you can develop a budgeted savings plan by setting up automatic transfers of money to your savings account. Click here to check out our rates!

Savings Account

An Extra Credit Union savings account enables you to:

- Become a member and open your account with a minimum deposit/purchase a share in the credit union of $5

- Add optional sub-accounts as needed

- Incur no minimum balance

- Earn interest that is compounded and paid quarterly on balances that are over $100

Youth Savings Account

A parent, family member, or friend can open a youth savings account for anyone under the age of 17 and help save for their future.

- Open the account with a one-time, $5 membership deposit, which is required to purchase a share of membership in the credit union

- Deposits and withdrawals can be made in any amount

- Account interest is compounded and paid quarterly

Certificates of Deposit

A CD guarantees that you will save for a particular time frame, and that you’ll keep funds in your account without withdrawing any. Choose the amount you want to invest and the period of time to keep the funds on deposit. Remember that the longer the term of your CD, the higher your rate of return.

Certificates of deposit:

- Are a secure way to invest

- Provide a higher and guaranteed interest rate than a savings or money market account

- Have a minimum balance requirement of $500

- Offer terms from 180 days to 60 months

- Enable you to cash in your CD with interest earned or roll it over into another CD when the maturation date arrives

- Do not allow for early withdrawals

Money Market Account

Would you like your funds to earn more interest than a savings account and have ready access to your funds while they are being invested? Open a money market account. You can make higher dividends based on your savings balance. The higher your savings tier, the more you’re paid.

Here’s how a money market account works:

- Start with a minimum $5,000 deposit (For the youth money market, the minimum balance is $2,000).

- A balance between $20,000 and $49,999 earns a higher interest rate

- A balance of $50,000 and up earns our highest money market interest rate

- Interest is compounded and paid monthly

* Per federal regulations, transfers or withdrawals from an Extra Credit Union savings account are limited to six per calendar month.

Make The Switch

Our Quick Switch Kit makes it easy!

- Become a member by completing our membership application online, calling us at (586) 276-3000 or visiting any Extra Credit Union location.

- Use our account closure form to close any existing accounts with other financial institutions.

- Use the direct deposit form to redirect your payroll check into your new Extra Credit Union savings or checking account. If you receive pension or Social Security checks, be sure to notify the pension provider or government agency, as well.

- Use the automatic payment form to notify any companies that currently receive automatic payments from you that you’ve moved your account to ECU.

Online Banking

With Extra Credit Union, you can access your accounts whenever and wherever you want: at 2 a.m. after finishing a school project; at 7 a.m. as you sip your coffee before work; or just because.

Extra Credit Union Offers:

- Banking On The Go

- eBanking & eBill Pay

- Other Services

- Access Your Accounts

Headed to college or moving away for a new job? No worries; we have nearly 30,000 ATMs throughout the country through the CO-OP Network. Yep, that’s more surcharge-free ATMs than just about any bank, anywhere.

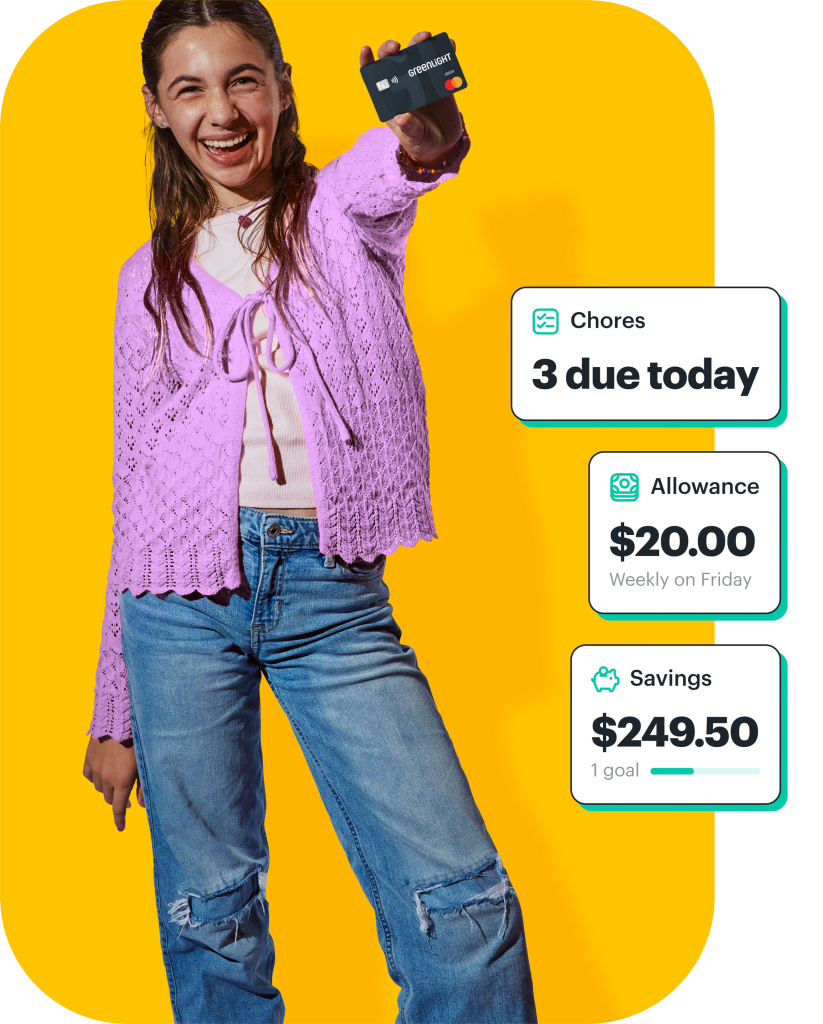

Greenlight

A debit card for kids. And so much more.

Greenlight is the loved, trusted debit card and money app for kids and teens that helps families raise financially-smart kids and manage every day financial tasks—and it is now available to you for free!*

- Money Management: Send money instantly, set flexible controls, and get real-time notifications.

- Chores and Allowance: Assign chores and automate allowance with the option to connect payouts to chore progress.

- Savings Goals: Set savings goals for what your kids really want – and reach them together.

- Financial Literacy Game: Kids play Greenlight Level Up™, the game that makes money concepts easy to understand and fun to learn.

Get your free* Greenlight subscription today.

*Extra Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their Extra Credit Union account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, customers will be responsible for associated monthly fees. See terms for details. Offer ends 12/11/2027. Offer subject to change and partner participation.

Life Plans

Do you have big dreams and goals? Well, what are you waiting for? The clock is ticking!

Be it personal or professional, Extra Credit Union wants to help make your goals and dreams a reality. Whether you want to become a professional artist, check that trip to Ireland off your bucket list, move your growing family into a new home, or finally purchase that boat you’ve been eyeing—we’re happy to help you make those life plans come to fruition.

We know you’ve got the brains, but sometimes you may not know what steps to take to reach your financial goals. No worries—Extra Credit Union can help! The information in this section will help you move closer to your goals.

Plus, we also have cool money management tools to help you, so be sure to check ‘em out.

Go ahead and get started on those plans! And the knowledgeable and experienced staff members at Extra Credit Union will be waiting and ready when you need them.

Buy and Own a Car

Beep! Beep! Time for a new set of wheels

We offer three types of loans related to your auto:

- Shopping for a new car? We can help you get an auto loan.

- Feeling the strain of a high auto payment? Pay less for the car you drive by refinancing your loan!

- Car paid off? Let us help you pay off other debts and more by using the equity in your vehicle.

Get an auto loan to purchase a car

Ready to purchase a new or used car? ECU offers auto loans with fair interest rates and flexible terms based on the vehicle that you choose. We will work closely with you to get you an auto loan no matter your credit score.

Together, we will:

- Review your credit and work with you to get you the best, most affordable loan

- Educate and advise you on affordable vehicles that work within your budget, thereby setting you up to succeed

- Determine the value of the vehicle(s) you are interested in and the most you should pay, prior to meeting with the dealer

- Pre-approve you for a loan up to the amount that you qualify for to protect you from overpaying at the dealership

Your new car is just around the corner. Call us at (586) 276-3000 or (877) 638-7628, or visit Extra Credit Union and we’ll get you on the road to getting your vehicle!

Or let us protect you with a vehicle history report—members get an exclusive discount on Carfax.

Purchase a Home

Your castle awaits…

At Extra Credit Union, we know the thrill of owning your first home … and running around your new house screaming, “It’s mine! It’s mine! Ahhh, this is so cool!” We, as well as our partner Member First Mortgage, will guide you every step of the way on your exciting journey toward a new house.

If you’re already a homeowner, we’ll help you refinance to lower your payments, or to tap into your home’s equity for large purchases, such as that perfect living room couch, coffee table, and lamp you’ve had your eye on.

Home Purchasers

As home costs and interest rates are at an all-time low and as rent continues to increase, you’ll find home ownership more affordable. Come to us with good credit and a commitment to a mortgage, and you may become the next proud owner of a home.

Extra Credit Union and Member First Mortgage provide members with historically low interest rates and access to a full range of mortgage loan programs, including FHA, MSHDA, adjustable rate, and fixed rate for those who qualify. We are happy to walk you through the process of finding the best mortgage and payment plan for your needs.

Prior to looking for a home, here are the steps to take:

- Determine your monthly budget. Remember that your housing should not be more than 30 percent of your monthly income.

- Meet with our mortgage expert, to determine if you are qualified for a mortgage loan based on your income, assets and credit. In addition to pre-qualifying you, this process will determine the maximum purchase price you should be looking for and your total monthly payment.

- Seek a Realtor or seller to find your dream home. When you find your dream home, go ahead and make an offer.

- When your offer is accepted, we will collect the necessary documentation, order an appraisal, get you a full approval, and schedule a closing {this is where you get the keys to your castle}.

Refinance your Home

No one wants to pay more for their home than necessary. Many ECU members are thrilled to reduce their monthly mortgage payments through refinancing.

We will sit down with you and review your existing mortgage and interest rate to determine whether we can lower your rate, thereby reducing your monthly mortgage payment.

Acquire a Home Equity Line of Credit (HELOC)

It’s important that you have access to funds when you need them. Use the financial power of your home’s equity to get a new roof, pay for college or even plan for the “Big Day.”

If you have built equity in your home, you can access it through a Home Equity Line of Credit. We are happy to help you leverage your home to benefit other areas of your life with all the perks of this account, including:

- Variable rate home equity line of credit competitive base rates

- Quick access with a HELOC debit card or convenience checks at merchants, our Main Office or any CO-OP Network ATM location

- No costly start-up fee {some restrictions may apply} or closing costs

- Potential tax benefits {consult your tax adviser}

- Worldwide acceptance at participating MasterCard® merchants

Applying is easy and available 24/7:

- Apply online: There is no obligation.

- Apply in person: Sit down with and chat with one of our lenders.

- Apply by phone: Call (586) 276-3000. We are available 24 hours a day, 7 days a week.

*A $200 processing fee will be assessed if an advance of $5,000 or more is not made at closing or if pre-payment is made in full within 24 months.

Get Through Tough Times

Tough times build character, right?

Tough times can do a number on us. We can lose focus, drive, and hope. Don’t stress—Extra Credit Union is here to help you through life’s challenges and guide you toward emerging in a stronger place.

Money Management Services

If you struggle financially, we will introduce you to our partner, GreenPath, to help you develop a plan to manage your money and move toward a stronger financial foundation. Many of the nonprofit organization’s services are offered at no cost to you because you’re a member. Confidentially, they will help you:

- Get on a debt management plan: You no longer need to be overwhelmed by bills; create a plan that brings you clear direction, out of your difficulties and toward peace of mind.

- Develop a personal/family budget: It’s easy to let our spending control us. Learn to develop a budget and change your habits.

- Acquire housing counseling: There’s so much to know when buying a house, or when selling your home, so we’re here to help you through the process.

- Avoid bankruptcy, foreclosure, and repossession: There’s no shame in experiencing hard times. We can help you avoid them or get through them.

Certified Financial Counselors are available 8 a.m.-12 a.m. Monday-Thursday, 8 a.m.-7 p.m. Friday and 9 a.m.-1 p.m. Saturday. Call 1-877-337-3399 to speak with a GreenPath representative. Mention you are a member of Extra Credit Union.

If you are not sure of what the bumpy road has done to your credit, we can help right here at Extra Credit Union:

- Understand your credit report: We’ll examine your credit score with you to ensure reporting is accurate, and offer tips to save money and improve your credit score. Appointments are made in advance for this service. Call (586) 276-3000 to schedule your credit report review.

- Can’t seem to manage all those bills? We may be able to pay off some of your higher interest debt, store charge cards, medical bills and more. Lessen your burden by applying for a debt consolidation loan with our Debt Crusher Program.

Financial Planning

Retirement, family planning, insurance, investments—yep, we do that!

Wouldn’t it be great if someone could be your guide toward your financial future? Poof! Your wish is granted. At Extra Credit Investments located within Extra Credit Union, we know that people are experiencing tough economic times. We say, don’t let it stop you.

At Extra Credit Investments, we can create a guide to pursue and maintain a strong financial foundation. Our on-site financial consultant seeks to earn your trust by helping you to:

- Develop a long-term financial plan

- Prepare for large life decisions

- Explore several financial tools that may gain you higher yields

Steve Ellsworth, our on-staff financial consultant with LPL Financial, takes a holistic approach to financial planning. He’ll assist you at any stage of your life with a process to:

- Gather important information to accurately understand your unique needs

- Assess your short- and long-term goals, background and current assets

- Evaluate where to direct your financial resources for the most successful outcomes

- Consider wealth management opportunities

To learn more about how you may benefit from our financial consulting services, visit our designated Extra Credit Investments site, or schedule a complimentary appointment by calling Steve at (586) 276-3108.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Extra Credit Union and Extra Credit Investments are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Extra Credit Investments and may also be employees of Extra Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Extra Credit Union or Extra Credit Investments. Securities and insurance offered through LPL or its affiliates are:

Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed |

Not Credit Union Deposits or Obligations | May Lose Value |

The LPL Financial Registered Representative associated with this site may only discuss and/or transact securities business with residents of the following states: AK, FL, MI, NM, NY, VA.

Love My Credit Union Rewards Program

Members can save up to $15 on TurboTax online federal tax products with the credit union member discount through Love My Credit Union Rewards. Click/tap here for more information.

Members can save hundreds on car insurance with the TruStage Auto & Home Insurance Program. Combine auto and homeowner’s coverage and you could save even more. Restrictions apply. See website for complete details.

Save up to $25 with professional tax help. Get the details.

Looking to get outdoors? Take advantage of credit union member pricing with the Love my Credit Union Rewards Powersports and RV Buying Program. Get the details.

Rent builds good credit. Add all of your past rent onto your credit report with Rental Kharma. Get the details.

Members get exclusive access to home tech protection and support. Get all the details.

eStatement FAQs

eStatements is an online service and electronic statement delivery method that allows you to receive, view, and print your current and past Extra Credit Union account statements. eStatements contain the same information as a paper statement.

You will need access to eBanking via the Internet, an email address, and Adobe Acrobat Reader software installed on your computer.

It’s easy and there a just four steps to follow:

Step1: Log in to eBanking.

Step 2: Click on the Services tab and then select the eStatement Registration option.

Step 3: Select eStatement, under Statement Type. Then enter your valid eMail address. Click, continue.

Step 4: Review the eStatement Agreement and confirm your eStatement Preference Selection. Click submit.

If you receive a monthly or quarterly statement, your next statement will be accessible online at the end of the statement cycle. Every month, you will receive an email reminder when your eStatement(s) are ready to be viewed. This will be close to the first day of the month, and several days before a paper statement would arrive in the mail.

You will be notified via email (sent to the email address you supplied us during registration) that your statement is ready.

No. Once you register for eStatements, you will no longer receive paper statements via U.S. mail.

No. This is an added benefit.

Yes. If you wish to return to paper statements, visit Extra Credit Union or call (586) 276-3000 or toll-free at (877) 638-7628. Depending on the timing of your request, you may receive one electronic statement before your account converts back to mailed paper statements.

If you need any assistance, please call (586) 276-3000 or toll-free at (877) 638-7628.

Account FAQs

ATM deposits are held for a minimum 2-business-day hold. This includes check and cash deposits.

To update your address on your Extra Credit Union account, complete the account change card. This form can be obtained at any of our locations.

There is no minimum balance requirement. View our Fee and Service Charge Schedule for associated account fees.

To make a legal name change, we must receive a completed account change card and be provided with a valid driver’s license or marriage license.

To add a person as a joint party on your account, please send a completed application by mail to:

Extra Credit Union, ATTN: Member Services, 6611 Chicago Road, Warren, MI 48092

Be sure to include your current account number, all completed joint party information (including a copy of the joint parties ID and Social Security card), and signatures from all current account owners as well as the new joint party’s signature.

Yes. Extra Credit Union’s ATMs are part of the CO-OP Network. There are more than 30,000 FREE ATMs available to you throughout the United States, Canada and Puerto Rico on the CO-OP Network.

No. Every member must open a savings account before adding any other type of account. The deposit of $5 represents a member’s share in the credit union and is nonrefundable.

Access your account information:

- Online using eBanking

- Personal Anytime Teller (PAT), available at (586) 276-3000, option 2

- Contact a call center representative by phone at (586) 276-3000 or toll-free (877) 638-7628. Hours are Monday – Tuesday from 9 a.m. – 5 p.m., Wednesday from 11 a.m. – 5 p.m., Thursday from 9 a.m. – 5 p.m., and Friday from 9 a.m. – 6 p.m.

Yes. Some restrictions apply.

All members are required to open a savings account. There is a $5 deposit required to purchase a share of membership in the credit union that must be retained in the Primary Savings account at all times.

No activation is needed.

To change the PIN on your ATM or Debit Card, contact a call center representative by phone at (586) 276-3000 or toll-free (877) 638-7628. Hours are Monday – Tuesday from 9 a.m. – 5 p.m., Wednesday from 11 a.m. – 5 p.m., Thursday from 9 a.m. – 5 p.m., and Friday from 9 a.m. – 6 p.m.

Your records will show immediate deductions/additions to your account. eBanking will not reflect any transactions that have not yet cleared your account, such as checks written but not yet cleared or pending debit transactions. Your records might not include dividends earned or service fees deducted.

Lost/Stolen Card?

We Can Help.

Lost or stolen checks should be reported as soon as possible at Extra Credit Union or by telephone at (586) 276-3000 or (877) 638-7628.

Call the JHA Hot Card Center: (888) 297-3416 (within the US) or (206) 389-5200 (outside the US).

To report a lost or stolen ATM Card, please call the credit union during normal business hours at (586) 276-3000.

Call the JHA Hot Card Center: (888) 297-3416 (within the US) or (206) 389-5200 (outside the US).

To activate your debit card, contact a call center representative by phone at (586) 276-3000 or toll-free (877) 638-7628. Hours are Monday – Tuesday from 9 a.m. – 5 p.m., Wednesday from 11 a.m. – 5 p.m., Thursday from 9 a.m. – 5 p.m., and Friday from 9 a.m. – 6 p.m.

ECU FAQs

Those who reside, work, worship or attend schools within the state of Michigan.

Yes, we do. Safe deposit boxes are available at our main office and accessible during lobby hours.

Credit unions are not-for-profit financial institutions that conduct business for the mutual benefit and general welfare of their member-owners. Banks are for-profit financial institutions who conduct business to maximize the price of its stock and profit for stockholders.

To wire funds to Extra Credit Union from another financial institution, you will need to provide the other financial institution with the following information:

- Extra Credit Union, 6611 Chicago Rd., Warren, MI 48092

- Routing Number: 272477432

- The account number you would like the funds transferred to

You may request to close your account in person at Extra Credit Union or by written request. Please be sure to include your signature with your written request for verification.

Mail your request to:

Extra Credit Union, ATTN: Member Services, 6611 Chicago Road, Warren, MI 48092

The routing number (ABA) at Extra Credit Union is 272477432.

Routing Number: 272477432